HedgeStar assists all types of entities with meeting ASC 820 requirements. Our team will classify assets and liabilities based on the fair value hierarchy, apply accepted valuation techniques to measure fair value, and determine non-performance risk. We work closely with auditing firms to verify that assets/liabilities are classified correctly and to confirm that our methodology is consistent with the current practice for similar entities.

ASC 820, creates a new standard definition of “fair value,” provides a methodology for determining the fair value of assets and liabilities (including derivatives and hedging products) by using a hierarchy of inputs (Level 1, Level 2, Level 3), requires using valuation techniques consistent with conventional approaches (market, income, and/or cost), and clarifies the need to include certain assumptions about risk, market illiquidity, and nonperformance risk in measuring fair value.

Statements generated monthly, quarterly or annually for ASC 820 valuation and reporting requirements. Used by clients and auditors for independent documentation of ASC 820 compliance.

Hedge memo for ASC 820 economic hedges. Used by clients to document economic hedges for auditors when not using hedge accounting standards.

Interface between HedgeStar and client’s auditor. Includes calls, emails, and documentation. Used by clients to streamline burden of interfacing with auditors about fair value.

Classification and reporting of assets and liabilities based on the ASC 820 fair value hierarchy. Used by clients lacking the knowledge or resources needed to identify and report financial instruments per the fair value hierarchy.

Calculation of non-performance risk per ASC 820 standard. Used by clients lacking the knowledge or resources needed for such calculations, especially those with large and heterogeneous portfolios.

Definition of Fair Value: ASC 820 standardizes the definition of fair value to mean the exit price of a transaction not the entry price. Specifically, “Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.”

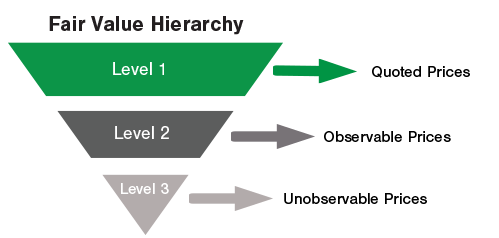

Fair Value Hierarchy: In an effort to ensure that fair value measurements are market based or based upon assumptions that market participants would actually use when pricing an asset or liability, ASC 820 establishes a three level fair value hierarchy. In this hierarchy, ASC 820 requires that the use of observable inputs for pricing is maximized and the use of unobservable inputs for pricing is minimized when determining fair value.

Level 1 pricing inputs are observable inputs such as quoted prices, available in active markets, for identical assets or liabilities on the date of measurement.

Level 2 pricing inputs are either directly or indirectly observable inputs available in active markets as of the measurement date. They can be quoted prices for similar assets or liabilities in active markets, they can be quoted prices for similar or identical instruments in markets that are not active, they can be observable inputs (not quoted prices) such as yield curves, interest rates, or default rates, among others, which are observable at commonly quoted intervals, or they can be market corroborated inputs.

Level 3 pricing inputs are unobservable inputs used in cases where financial instruments are considered illiquid, with no significant market activity and little or no pricing information on the date of measurement.

Disclosure Requirements: Disclosure requirements under ASC 820 vary depending upon how a security is classified under the fair value hierarchy. Securities classified as Level 1 require the least amount of disclosure, while disclosure requirements for securities classified as Level 3 were actually expanded under ASC 820. Under ASC 820, the impact of earnings on Level 3 investments must be disclosed and changes in Level 3 investments must be reconciled between periods.

Valuation Techniques: ASC 820 promotes using valuation techniques consistent with conventional approaches to measure fair value.

Market Approach: The market approach uses prices and other relevant information generated by market transactions involving identical or comparable assets or liabilities. An example of the market approach is matrix pricing.

Income Approach: The income approach uses valuation techniques to convert future cash flows to a single present amount using discounting. Values are measured by using current market expectations about future amounts. Examples of income approach are interest rate swaps and option valuations.

Cost Approach: The cost approach is based on the amount that would be required to replace the service capacity of an asset in today’s market. The price that would be received for the asset is based on the cost to acquire or construct a substitute asset.

The preparer of a financial statement is allowed to use a combination of techniques to value assets and liabilities.

Additional Clarifications: ASC 820 clarifies that if market participants would use an assumption about risk in pricing the relevant security, then the fair value measurement should include assumptions about risk. If market participants would use an assumption about lack of liquidity in the market when pricing the relevant security, then the fair value measurement should include assumptions for restrictions in the sale or use of a security. ASC 820 clarifies that nonperformance risk, such as the impact of an entity’s credit standing or any posted collateral, should be taken into consideration in the fair value measurement.