Derivatives started gaining popularity as hedging tools in the 80s and companies were exploring better ways to account for them. The Financial Accounting Standards Board (“FASB”) responded with its first hedge accounting standard in 1984 with topic 80, Accounting for Futures. Fast forward to the 90’s and both the use and complexity of derivatives were increasing in lockstep with market demand. FASB created the Derivatives Implementation Group (the “Dig” – see pun above) to serve as advisor and help usher in topic 133, which is the accounting grandchild of what we know today as ASC 815.

Putting aside the MTM and cash flow dollar amounts, we are left with two bookkeeping hurdles to jump. The first relates to timing, or the period in which those entries will be recorded. The second relates to financial statement geography, or the general ledger accounts to which the entries will be recorded.

With the first hurdle, users must record the MTM value and any cash flow settlements immediately in earnings (absent any hedge accounting designation). We know that derivatives, and their MTM values, are driven by changes in the price or rate of the underlying asset, commodity, index or security2. Said another way, the change in derivative MTM value is reflective of the price volatility of the market in which the underlying asset resides. A prudent person can expect a derivative value to change often and meaningfully, and therefore, the issue inherent in hedging activities is that this price volatility translates directly to earnings volatility thanks to our accounting requirement.

The second hurdle asks the question: where do we put gains/losses and settlements? The change in derivative MTM value is not recorded “above the line,” or as part of Operating Income/Expense. Rather, it is reflected in an Other Gains/Losses or Other Income/Expense line item. The problem here is that users want the impact of hedging activities reflected in their operating margin. Waxing and waning amounts in accounts labeled “Other” is a red flag for auditors and does little to assuage the perception that the derivatives are being used for anything other than speculation. Thus, the optics are reason enough to look elsewhere for help. Enter hedge accounting…

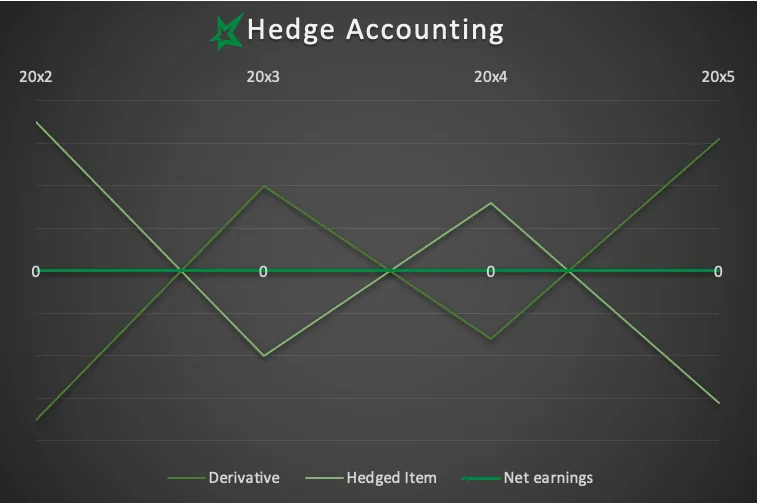

The benefit of hedge accounting is that users can offset adverse changes in value or cash flows between a hedging derivative and a hedged item. Journal entries that are recorded in the income statement are timed to reflect amounts of value or cash flow changes between the hedging derivative and hedged item in the same period. This entry is also made such that the derivative effect is recognized as an offset in the same line item to the hedged item. The effects of both the timing and geography of the entries significantly reduces earnings volatility for user entities. The visual depiction of hedge accounting is as follows:

This article ignores a critical part of hedge accounting, which is the hedge effectiveness testing requirement. This is the “proof” (alluded to previously) that qualifies users for hedge accounting. Effectiveness testing is a meaty topic in its own right, necessitating its own article. Also, effectiveness testing involves statistical analysis, and I felt that an article based solely on accounting was punishment enough – you’re welcome!

Hedge accounting can be challenging. It requires vigilance and dedicated resources to manage important tasks such as documentation, hedge effectiveness testing, monitoring hedged items and recording journal entries. Addressing these requirements is often a coordinated effort across team members in operations, treasury, accounting, internal audit and other areas. As such, entities must make budgetary considerations to either provide sufficient resources internally, or hire third-party outsourced expertise to cover the needs.

HedgeStar can provide a bridge solution to help launch entities seeking hedge accounting, or completely alleviate the burden for entities as a long-term, outsourced provider. Call a HedgeStar expert today!

[1] The foreign equivalent is International Financial Reporting Standards number 9. Governmental Accounting Standards Board paragraph 53 is the standard for municipal institutions.

[2] For more information on derivatives, please refer to our article on “What is a derivative?”

Contact the Author:

Craig Haymaker, CPA, Managing Director

Mobile: 952-240-1984

Office: 952-208-5704

Email: chaymaker@hedgestar.com

Media Contact:

Megan Roth, Marketing Manager

Office: 952-746-6056

Email: mroth@hedgestar.com

Did you miss our last article? Check it out today!