My mom has never crashed her car. Not once. And yet, she remains a devout USAA Car Insurance customer. My daughter takes candy from my son’s Halloween coffers. Knowing I despise this, she sets some of her spoils aside for me (in case I catch her). Goldman Sachs securitized billions in mortgage-backed securities and then infamously bet against them using synthetic Collateralized Debt Obligations – a noteworthy precursor to the global economic crisis. These are all examples of hedging.

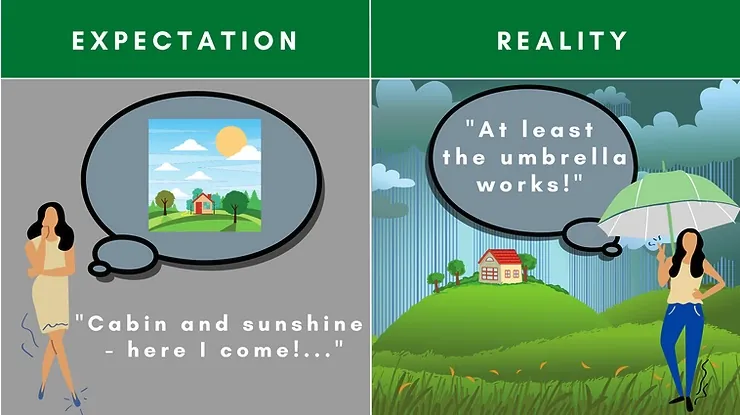

Before we discuss hedging, we must first address the concept of risk. ‘Risk’ translates differently from person to person, entity to entity. COSO describes risk as a possible event with a negative impact [1]. I once heard Ali Samad-Khan [2], the “godfather of operational risk management,” define risk simply as the deviation from an expectation. Bringing this concept to life, the risk to mom is crashing the car and then forking over thousands of dollars for repairs. With my daughter, the risk is being caught in the act and surrendering the candy (notwithstanding my own risk of witnessing catastrophic meltdown).

For most entities, risk is more granular. It speaks to the performance of some function relative to a benchmark (i.e., budget). For example, an entity might define risk as the likelihood of diesel fuel prices exceeding $5/gallon, or the CBOE Volatility index reaching 50%. Many suffer heartburn from the fundamental variability inherent in markets that causes important measures, such as operating margin, to run amok – casting doubt on financial targets and putting incentive-based compensation on ice. Thus, if risk is indigestion, then hedging is Pepto Bismol™!

Hedging refers to the process of mitigating adverse outcomes caused by exposure to fluctuating, market-driven inputs. These inputs could be interest rates, exchange rates, or commodity prices. Often, it involves derivatives [3] and serves to alleviate undesirable impacts to cash flow, enterprise value, or all of the above.

Historical precedent suggests that hedging began as far back as 2000 BC [4] when precious metals were used as trade currency. Accumulating gold was a hedge against regional crises and resource scarcity. More formal hedging is noted to have started in the mid-1800s with commodity futures and options [5]. The Chicago Board of Trade created the world’s first commodity exchange in 1848. It began with basic grain forward contracts in 1851, and then issued the first standardized grain futures contract in 1865 [6]. Today, hedging is commonplace and generally viewed as positive in the eyes of key stakeholders. For many organizations, hedging provides relief from market forces that are uncontrollable.

Hedging strategies have evolved over time but most stem from a few basic concepts. The first involves hedging a variable cash inflow or outflow. Consider, for example, an Original Equipment Manufacturer (OEM) that purchases steel to make widgets. Steel is an input price that fluctuates day-to-day, and thus the OEM’s raw material purchase amounts fluctuate in turn, causing unwanted volatility in its operating income. A long steel futures contract would mitigate the variable cash flow risk and lock-in a price for a specified period of time.

Another strategy relates to fixed-rate assets and firm commitments. Examples include mortgage loans for financial institutions, or a fixed-price sales contract like a forward delivery agreement issued by a silver mining operation, respectively. Fixed-rate assets and firm commitments have an economic value that changes inversely with a change in the underlying variable – in this case, interest rates and silver prices, respectively. Thus, the financial institution might execute a pay-fixed, receive-float interest rate swap whose value change would offset that of the mortgage loan. Similarly, the silver mine would trade a long silver futures contract that would offset the value change of its forward delivery agreement.

The last strategy is delta hedging. Delta hedging can be loosely defined as the process of maintaining the delta of a portfolio as close to zero as possible or being “delta neutral.” Delta means the ratio that compares the change in the price of an underlying asset to the corresponding change in the price of its derivative, such as an option or swap contract. Originally an options portfolio management concept, delta hedging has broadened in its application across all instrument types and asset classes. It is used by trading companies and financial intermediaries in almost every industry.

How does it work? Put simply, market makers and trading companies have market exposure on both the purchasing and selling sides of the business. These entities will measure their risk exposure across fixed and floating inflows, fixed and floating outflows and their corresponding derivatives positions to determine what their net position looks like today, and what their net position could look like given adverse changes in the market. This will indicate how sensitive the value of an entity’s net position is to changes in the markets in which they operate. For example, banks that offer swaps to their borrowers will try to maintain a net DV01 (Dollar value change given a 1 basis point move in interest rates, or delta) as close to zero as possible. In other words, said bank wishes to be market agnostic while locking-in spreads between their customers and interbank counterparties.

Of course, there are thousands of permutations of hedging strategies, tactics, and styles that entities may adopt. This is because every single entity has a different risk appetite that it is willing to shoulder in pursuit of its strategic objectives. Regardless of appetite (or lack thereof), risk is a part of doing business. Avoiding risk in its entirety is impossible, but it can be managed, and hedging provides a path for doing exactly that.

[1] Committee of Sponsoring Organizations of the Treadway Commission (“COSO”). Enterprise Risk Management – Integrated Framework – Executive Summary. Page 8. Copyright 2004.

[2] President of Stamford Risk Analytics and “One of the One Hundred Most Influential People in Finance” by Treasury & Risk Management magazine. https://www.linkedin.com/in/ali-samad-khan-28170917/

[3] Please refer to our article entitled ‘What is a derivative?” at https://www.hedgestar.com/single-post/what-is-a-derivative

[4] Robin Gu. November 2019. Section Regionalized Hedging: Emergence of hedging with gold. https://www.datadriveninvestor.com/2019/11/25/thousand-years-of-hedging-history-part-1/

[5] Cornford, Andrew. 1995. “Risks and Derivatives Markets: Selected Issues”. UNCTAD Review. Geneva: United Nations Conference on Trade and Development, p. 190.

[6] Timeline of CME achievements. https://www.cmegroup.com/company/history/timeline-of-achievements.html

Contact the Author:

Craig Haymaker, CPA, Managing Director

Mobile: 952-240-1984

Office: 952-208-5704

Email: chaymaker@hedgestar.com

Media Contact:

Megan Roth, Marketing Manager

Office: 952-746-6056

Email: mroth@hedgestar.com