HedgeStar assists governmental entities with meeting the new requirements of GASB 72. Our experts classify assets and liabilities based on the fair value hierarchy, apply accepted valuation techniques to measure the new definition of fair value, and determine non-performance risk of all revenue-producing investments. We work closely with auditors to verify that all assets/liabilities are in scope and to confirm that custodian or other investment service organizations are providing the additional information needed under GASB 72.

GASB 72 defines fair value as the price that would be received to sell an asset, or paid to transfer a liability, in an orderly transaction between market participants at the measurement date.

GASB 72 also describes which assets and liabilities should be measured at fair value and what information about fair value should be disclosed in financial statements. Investments are defined as securities or other assets that governments hold primarily for the purpose of income or profit.

Previously governmental entities were required to disclose how they arrived at their measures of fair value, if their measurement was not based on quoted market prices. GASB 72 expands those disclosures to categorize fair values according to their relative reliability and to include many alternative investments.

GASB 72 was developed in improve transparency regarding the fair value standards, and to improve consistency and comparability in governmental entities’ disclosures.

Definition of Fair Value: GASB 72 standardizes the definition of fair value to mean the exit price of a transaction, not the entry price. Specifically, “Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.”

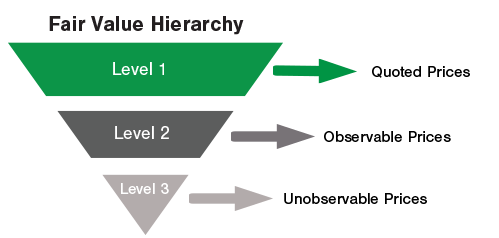

Fair Value Hierarchy: GASB 72 leverages the input hierarchy established by ASC 820 (FAS 157). This hierarchy ensures that fair value measurements are market based or based upon assumptions that market participants would actually use when pricing an asset or liability. The use of observable inputs for pricing is maximized and the use of unobservable inputs for pricing is minimized when determining fair value.

Level 1 – Pricing inputs are observable inputs such as quoted prices, available in active markets, for identical assets or liabilities on the date of measurement.

Level 2 – Pricing inputs are either directly or indirectly observable inputs available in active markets as of the measurement date. They can be quoted prices for similar assets or liabilities in active markets, they can be quoted prices for similar or identical instruments in markets that are not active, they can be observable inputs (not quoted prices) such as yield curves, interest rates, or default rates, among others, which are observable at commonly quoted intervals, or they can be market corroborated inputs.

Level 3 – Pricing inputs are unobservable inputs used in cases where financial instruments are considered illiquid, with no significant market activity and little or no pricing information on the date of measurement.

Disclosure Requirements: Disclosure requirements under GASB 72 include all income-producing investments. For recurring measurements, assets and liabilities must be adjusted to fair value at the end of each reporting period. For non-recurring measurements, assets and liabilities must be adjusted to fair value when other statements require or permit adjustment.

Valuation Techniques: GASB 72 promotes use of valuation techniques that are consistent with conventional approaches to measure fair value.

Market Approach: The market approach uses prices and other relevant information generated by market transactions involving identical or comparable assets or liabilities. An example of the market approach is matrix pricing.

Income Approach: The income approach uses valuation techniques to convert future cash flows to a single present amount using discounting. Values are measured by using current market expectations about future amounts. Examples of income approach are interest rate swaps and option valuations.

Cost Approach: The cost approach is based on the amount that would be required to replace the service capacity of an asset in today’s market. The price that would be received for the asset is based on the cost to acquire or construct a substitute asset.

The preparer of a financial statement is allowed to use a combination of techniques to value assets and liabilities.

GASB 72 was issued February 2015. It is effective for fiscal years beginning after June 15, 2015. GASB 72 compliance is mandatory starting with June 30, 2016 year ends. A one-year comparison period is also required, necessitating the application of GASB 72 to June 30, 2015 year ends as well.

As a leading independent provider of fair value services, HedgeStar is uniquely positioned to help your governmental entity meet GASB 72 requirements related to financial assets and liabilities. HedgeStar has a proven and automated process, approved by auditors, for determining fair value as defined by GASB 72 and we provide monthly, quarterly, and annual valuation reports to hundreds of clients.