Swaps are scary. Swaps are complex. Swaps are funky. Swaps are bespoke. Swaps are exotic.

These are phrases we have heard before and the tone is not necessarily incorrect, nor unjustified. Most swaps are executed over-the-counter (“OTC”), which means they are bilateral agreements negotiated between user and swap dealer. Theoretically, a swap could be molded into whatever the user needed it to be to achieve its goals, and often swap dealers are happy to oblige. Thus, it could be exotic, complex, bespoke, funky or even scary – but most are not. Much of the apprehension surrounding swaps can be attributed to a lack of education on the topic.

Let’s chat and let the learning begin!

A swap is a derivative [1]. Swaps typically “stand on two legs” – a receive leg and a pay leg. They can be customized to serve equity markets, debt/rates markets, currencies, or commodities. Swaps can be executed in two ways: a) OTC with a swap dealer, or b) cleared through a central clearing house [2].

It’s understood that the first swap was created in the late 1970s. It was made by British banks seeking to manage currency risk when translating UK pound sterling to US dollar to finance subsidiary operations in the US. [3] Though according to the World Bank Archives, the first formal swap was a currency hedge arranged between IBM and the World Bank itself in 1981. That contract was executed to swap Swiss Francs and Deutsche Marks to US Dollars. [4]

Most swaps are basic hedging tools used to convert floating cash flows to fixed cash flows, or vice-versa. Sometimes swaps are used to protect against significant swings in value. People often think of swaps as hedging a single instrument or a single risk exposure. But in reality, swaps can be used to hedge large portfolios, an institution’s balance sheet, interests in foreign subsidiaries and broader enterprise value. The list of viable, “hedgeable” risks goes on and on…

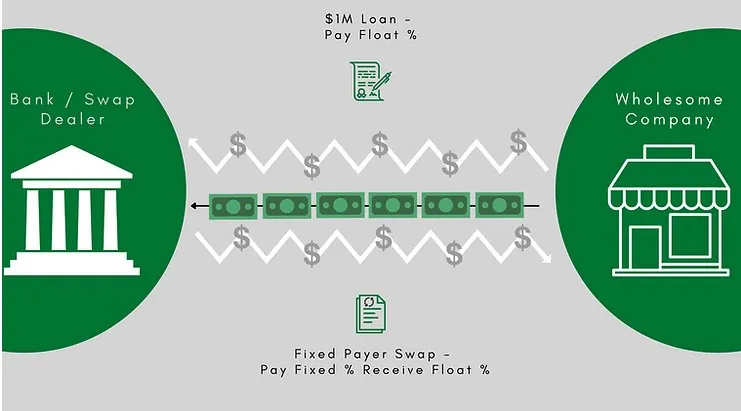

Let’s walk through a common swap example. Assume a company that has borrowed a $1M floating rate note from its bank is concerned about the variable nature of its future floating rate payments, and the potential for rates to rise. Unwilling to issue a fixed-rate note, the Bank may instead offer a pay-fixed, receive-float interest rate swap (“rate swap”) to the borrower. Provided the floating rate used to compute interest payments on the loan is the same as the rate swap, the floating payments on the loan should be equally offset by the floating receipts on the rate swap. The net result is a fixed payment stream on the rate swap. Objective achieved. Illustration shown below:

Swaps are a flexible, customizable instrument that have surpassed exchange-traded futures in popularity. In fact, the Bank of International Settlements puts the global swap market at ~368 trillion for currencies and interest rates versus the futures market for the same asset classes at ~29 trillion – more than 12x – in terms of notional principal, or quantity. [5]

Swaps are not to be feared, but understood. When used appropriately, they can be highly effective tools for financial risk management. Organizations must self-educate about the pros and cons of swaps. These tools should be executed in the context of a cogent framework and subjected to oversight by senior leadership and director-led committees. If the domain expertise is lacking, hire an independent third-party to provide the education necessary to make an informed decision on whether or not swaps are appropriate.

[1] Please refer to our article entitled ‘What is a Derivative?’ for additional information about derivatives.

[2] While OTC and cleared swaps may function the same, there are meaningful differences between the two, which will be addressed in a separate article.

[3] Currency Risk Management: Currency Swap by Brian Coyle. Page 24. Copyright Financial World Publishing 2000.

[4] The World Bank. “70 Years Connecting Capital Markets to Development: Chapter 4: Pioneering Swaps.” Page 64.

[5] Global OTC Derivatives Market. Global Tables D1 (Exchange Traded), and D5.1 (OTC). Page 1. Printed 1/28/22. https://www.bis.org/statistics/derstats.htm?m=6_32_71

Contact the Author:

Craig Haymaker, CPA, Managing Director

Mobile: 952-240-1984

Office: 952-208-5704

Email: chaymaker@hedgestar.com

HedgeStar Media Contact

Megan Roth, Marketing Manager

Office: 952-746-6056

Email: mroth@hedgestar.com

Did you miss our last articles on hedge accounting and derivatives? Check it out today!